On August 24, 2020, the Office of the United States Trade Representative revised the US$200 billion tariff exclusion list, adding 2 new excluded products and revising the descriptions of 8 historical excluded products.

The revised description and HS code of textiles are as follows. Export companies need to re-examine whether they meet the exclusion conditions:

5903.10.2090: Imitation leather fabrics of man-made fibers, impregnated, coated, covered or laminated with at least 60% polyvinyl chloride (PVC) and 75% plastic by weight.

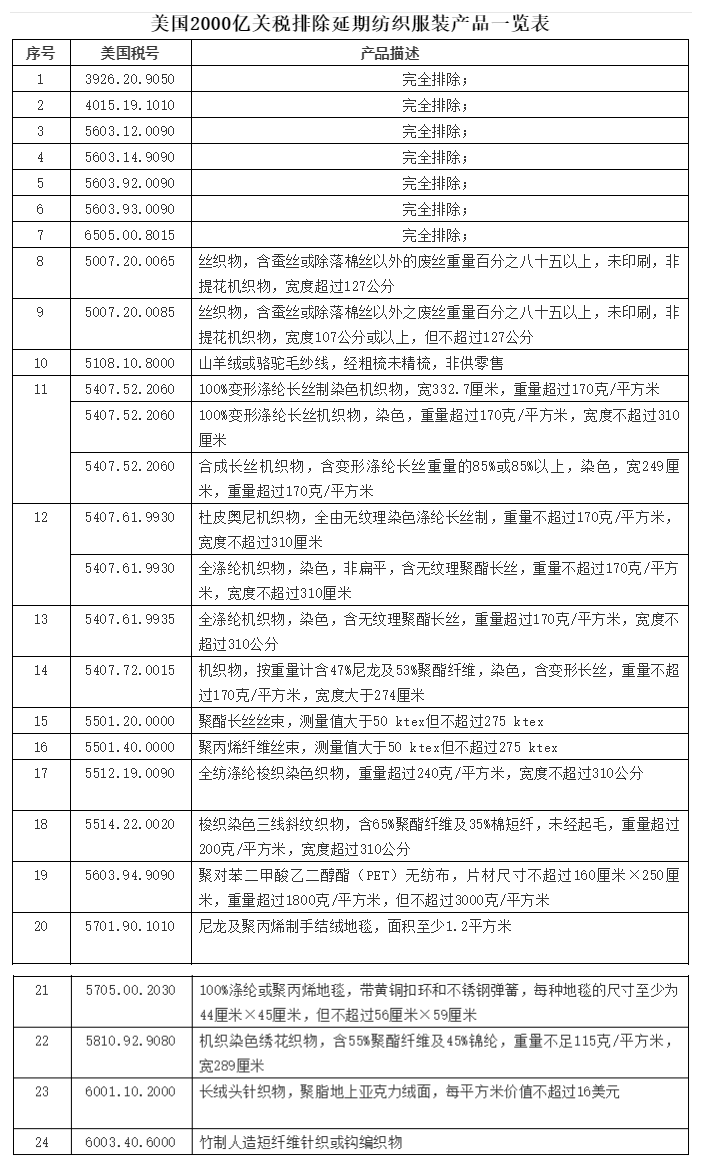

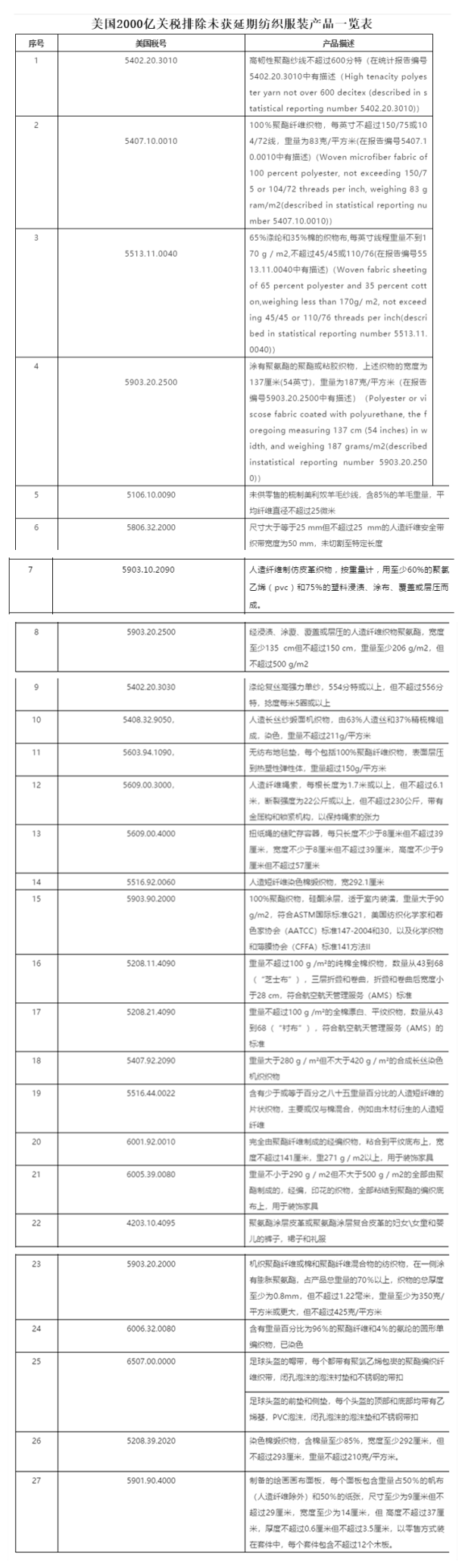

On August 6, 2020, Eastern Time, there were 997 items in the original US $200 billion tariff exclusion list, and 266 products had their validity extended (including 21 Completely excluded products), accounting for about 1/4 of the original list, including 24 tax codes for textile and clothing products. The exclusion period will be extended from August 7, 2020 to December 31, 2020; products that have not received the extension of validity period There are 731 items, accounting for about 3/4 of the original list, including 27 tax numbers for textile and apparel products. These products will resume the 25% tariff starting from August 7, 2020, Eastern Time.

UUSTR Notification Original text:

hhttps://ustr.gov/sites/defasdfssdfsult/files/enforcement/301Investigasdfssdfstions/Notice_of_Extensions_for_Exclusions_Expiring_August__7_2020.pdf</p